Tokenization of Assets

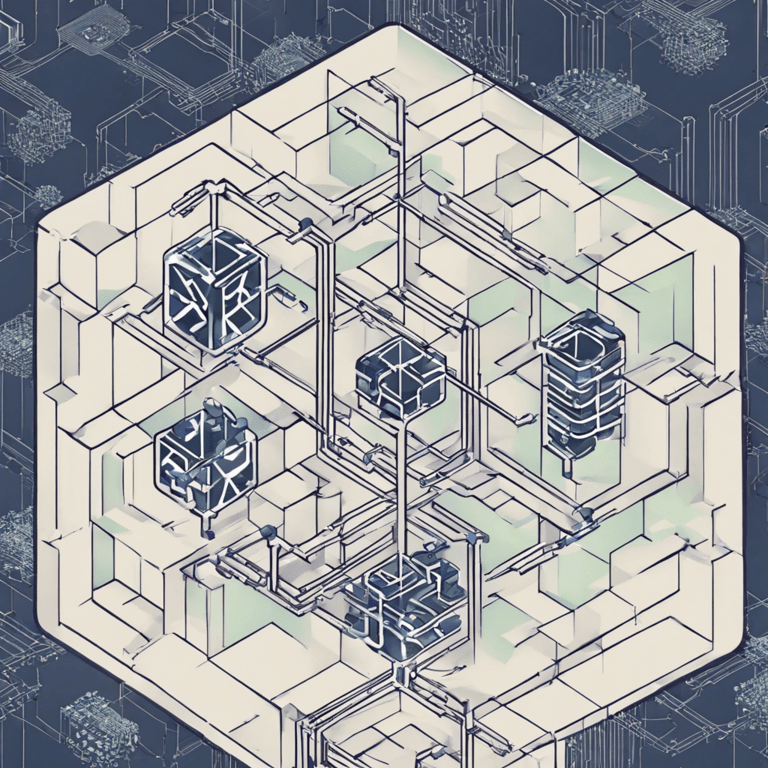

What Is Tokenization of Assets?

How Does It Work?

Benefits of Tokenization of Assets

• Greater Liquidity: By creating a more accessible and efficient way to trade assets, blockchain

tokenization can increase liquidity, making it easier for investors to buy and sell assets.

• Fractional Ownership: Tokenization allows assets to be divided into smaller fractions, allowing investors to own a portion of an asset that might otherwise be too expensive or inaccessible.

• Transparency and Security: By recording all transactions on a decentralized blockchain,

tokenization provides a transparent and secure way to manage assets, reducing the risk of fraud or theft.

• Lower Costs: Tokenization can reduce the costs associated with managing and trading assets, as it eliminates the need for intermediaries like banks or brokers.

• Access to New Markets: Tokenization allows assets to be traded globally, providing access to

new markets and investors.

Examples

- Blockchain tokenization is still a relatively new concept, but there are already some exciting

examples of its use in the real world. For example, a company called Harbor has developed a

platform that allows real estate assets to be tokenized and traded on the blockchain. This

provides greater liquidity for real estate investors, as well as reducing the costs and

administrative burden associated with traditional real estate investment. - Another example is the tokenization of artwork. Maecenas is a platform that allows art

collectors to buy and sell shares in valuable artwork, with each share represented by a digital

token. This allows collectors to own a fraction of a valuable artwork, which they can then sell or

trade on the blockchain.