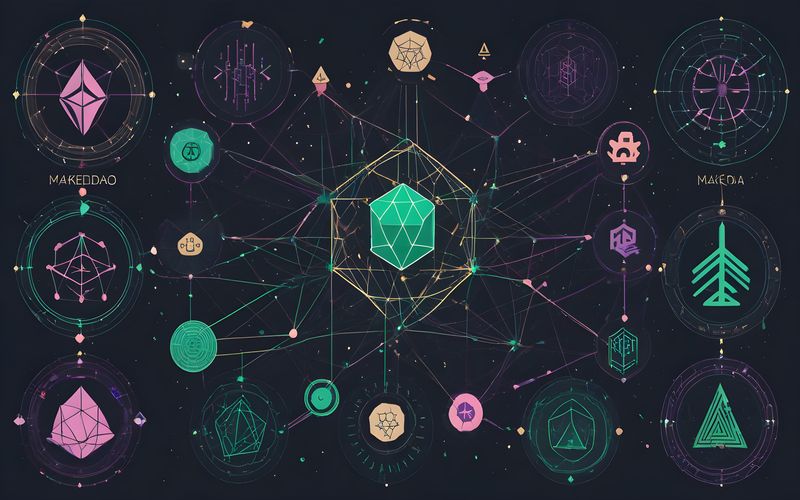

The financial sector is undergoing a profound transformation, driven by the emergence of decentralized finance (DeFi), a revolutionary paradigm that utilizes blockchain technology to establish a decentralized and democratized financial ecosystem. At the heart of this transformation lie DeFi contracts, self-executing agreements that operate on blockchain networks, enabling the creation of open, transparent, and secure financial applications.

Understanding DeFi Contracts

DeFi contracts, also known as smart contracts, are programmable code stored on a blockchain network. These contracts automatically execute predefined terms and conditions when certain conditions are met, eliminating the need for intermediaries and traditional financial institutions. DeFi contracts are built on the principles of decentralization and autonomy, fostering a trustless and censorship-resistant financial system.

Key Characteristics of DeFi Contracts

DeFi contracts possess several distinctive characteristics that set them apart from traditional financial contracts:

- Decentralization: DeFi contracts operate on decentralized blockchain networks, eliminating the need for centralized control or authority. This decentralization fosters trust and transparency within the financial system.

- Transparency: DeFi contracts are transparent, with their code accessible to the public. This transparency enables users to verify the contract’s functionality and security, enhancing trust and accountability.

- Security: DeFi contracts are secured by the underlying blockchain network, leveraging cryptographic algorithms and distributed ledger technology to safeguard against fraud and manipulation.

- Automation: DeFi contracts execute automatically upon meeting predefined conditions, streamlining financial transactions and reducing the need for manual intervention.

Applications of DeFi Contracts

DeFi contracts have opened up a vast array of possibilities for financial applications, transforming traditional financial services:

- Decentralized Exchanges (DEXs): DEXs facilitate peer-to-peer trading of cryptocurrencies without intermediaries, enabling seamless and efficient token exchange.

- Lending and Borrowing Platforms: DeFi contracts power lending and borrowing platforms that allow users to lend or borrow cryptocurrencies, generating passive income or obtaining liquidity without traditional banking procedures.

- Decentralized Stablecoins: DeFi contracts have enabled the creation of decentralized stablecoins, cryptocurrencies pegged to fiat currencies or commodities, providing a stable medium of exchange.

- Decentralized Insurance Protocols: DeFi contracts are being used to develop decentralized insurance protocols, offering users alternative insurance options with transparent risk assessment and payouts.

Benefits of DeFi Contracts

DeFi contracts offer several compelling benefits over traditional financial systems:

- Accessibility: DeFi contracts are accessible to anyone with an internet connection, overcoming geographical barriers and promoting financial inclusion.

- Efficiency: DeFi contracts automate transactions, reducing processing times and associated costs.

- Transparency: DeFi contracts are transparent, enabling users to track their funds and transactions with full visibility.

- Security: DeFi contracts are secured by blockchain technology, providing a robust defense against fraud and manipulation.

Challenges and Future Directions

Despite their transformative potential, DeFi contracts face certain challenges:

- Complexity: DeFi contracts can be complex, requiring specialized knowledge to understand and utilize, potentially limiting accessibility to a wider audience.

- Regulatory Uncertainty: The regulatory landscape for DeFi is still evolving, creating uncertainty for developers and users.

- Integration with Existing Systems: Integrating DeFi applications with traditional financial systems remains a challenge, limiting their widespread adoption.

Researchers and developers are actively addressing these challenges, continuously refining DeFi protocols and exploring new applications to enhance their usability, security, and regulatory compliance. As DeFi matures, it is expected to play a transformative role in the future of finance, empowering individuals to take control of their financial lives and fostering a more open, accessible, and equitable financial ecosystem.

New Era of Decentralized and Democratized Finance

DeFi contracts represent a paradigm shift in the financial landscape, ushering in a new era of decentralized and democratized finance. By leveraging the power of blockchain technology, DeFi contracts enable the creation of transparent, secure, and user-centric financial applications that have the potential to revolutionize the way we interact with and manage our finances. As DeFi continues to evolve, it is poised to play an increasingly important role in shaping the future of finance, empowering individuals and transforming the global financial system.

Disclaimer

FAQ

DeFI stands for decentralized finance, offering open and accessible financial systems built on blockchain technology.

Yield farming involves earning interest by lending or staking cryptocurrencies.

Layer 1 blockchains are the primary networks (e.g., Ethereum), while layer 2 blockchains scale and improve performance on top of them.